Many manufacturers believe they have a handle on cost accounting for food manufacturing. However, when every shift change, recipe tweak, co-packing run, or ingredient swap can impact your actual cost per unit, standard costing often reveals more than it hides. Yield losses, labor overruns, packaging waste, and utility fluctuations rarely show up on the surface, but they quietly erode your margins.

According to CSIMarket, the gross profit margin for the food processing industry was 21.59% in Q1 2025, slightly below the average of 21.81%. In a business where margins are thin and volatility is the norm, even minor miscalculations in product costing can lead to mispriced SKUs, unexpected write-offs, or the wrong products getting the spotlight.

That’s why cost accounting for food manufacturing needs to be dynamic, continuous, and grounded in real-time data, not a quarterly spreadsheet ritual. In this blog, we’ll break down how poor cost visibility chips away at profitability, and what top food processors are doing differently to turn costing into a competitive edge.

Why Traditional Cost Accounting Falls Short in Food Manufacturing

Traditional models of cost accounting for food manufacturing weren’t built for the complexity of modern food operations. While they work in static, low-variation environments, food manufacturing is anything but predictable. Perishable ingredients, fluctuating yields, and recipe-by-recipe variation demand a far more granular, real-time approach.

Here’s what “falling short” actually looks like on the production floor:

- Yield variability isn’t captured: Actual output often deviates from standard recipes due to moisture loss, trimming, or overcooking, but costing models remain static.

- Spoilage and short shelf life aren’t fully absorbed: Losses from expired or damaged inventory rarely get allocated back to product costs.

- Co-manufacturing and private label costs become blurred: Shared equipment, labor, and materials across brands obscure true cost visibility per SKU.

- Manual spreadsheets fail with dynamic recipes: Frequent reformulations and recipe management based on ingredient availability or customer specs aren’t reflected in costing updates.

- Line-level energy and labor costs are averaged out: High-speed vs. manual lines cost differently, but traditional accounting spreads overhead evenly.

Bottom line: Traditional cost accounting can make your margins look fine until the P&L tells a different story.

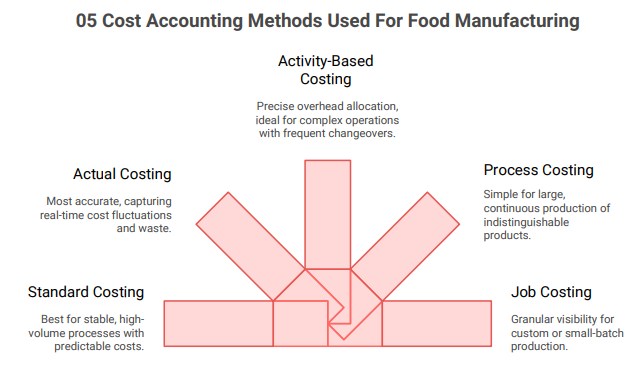

Breaking Down the Methods of Cost Accounting For Food Manufacturing

There’s no one-size-fits-all approach when it comes to cost accounting for food manufacturing. The right method depends on the complexity of your production, specifically, the number of SKUs you manage, the frequency of recipe changes, whether you co-pack, and the volatility of your ingredient and labor costs. Understanding the strengths and trade-offs of manufacturing costing methods is crucial for uncovering true product profitability and making informed decisions on rising food costs, promotions, and scaling.

1. Standard Costing

What it is:

Standard costing assigns a fixed cost to raw materials, labor, and overhead based on expected (or “standard”) values. Most ERPs use this by default because it’s simple to manage.

Use case:

A bakery producing white bread at scale might set a standard cost of $0.45 per loaf, based on forecasted flour prices, average baking time, and packaging costs.

Pros:

- Great for high-volume, repetitive processes

- Simplifies budgeting and variance tracking

- Works well when ingredient prices and yields are stable

Cons:

- Falls apart with seasonal cost spikes (e.g., egg prices in spring)

- Doesn’t reflect actual food inventory shrinkage, spoilage, or labor overtime

- Hides true margins, especially for SKUs with volatile inputs

Formula:

Unit Cost = Standard Material Cost + Standard Labor + Allocated Overhead

e.g., $0.30 (ingredients) + $0.10 (labor) + $0.05 (overhead) = $0.45 per loaf

Verdict:

Best for stable, low-variance ops. Dangerous if used blindly in dynamic or perishable categories.

2. Actual Costing (True Costing)

What it is:

This method of cost accounting for food manufacturing calculates unit costs based on actual data, including real ingredient prices, actual yields, true labor hours, and actual overhead incurred per batch.

Use case:

A fresh meal kit company tracks costs per SKU weekly. If ground beef price spikes or yields drop due to trim loss, the system reflects that in real time.

Pros:

- Most accurate reflection of cost and margin

- Captures waste, spoilage, rework, overtime, and over-portioning

- Helps with SKU rationalization and pricing decisions

Cons:

- Requires integrated systems and disciplined data entry

- Can get messy without automation or traceability tools

- Harder to standardize across multiple sites or co-packers

Formula:

Unit Cost = (Total Ingredient Cost + Labor + Overhead) ÷ Actual Output Units

e.g., ($2,300 + $850 + $500) ÷ 5,500 units = $0.60 per unit

Verdict:

A must for perishables, frozen foods, or small-batch makers. Worth the effort if accuracy drives profit.

3. Activity-Based Costing (ABC)

What it is:

ABC is a method of cost accounting for food manufacturing that assigns costs based on actual activities, such as setup, sanitation, QA, and changeovers, rather than generic overhead percentages. This approach reveals the hidden costs behind non-production time.

Use case:

A dairy co-manufacturer running short production runs for multiple clients uses a dairy ERP with ABC costing to reveal that setup time for allergen-free SKUs adds $0.12 per unit in overhead.

Pros:

- More precise overhead allocation

- Helps uncover operational inefficiencies

- Informs better scheduling and production planning

Cons:

- Data-heavy to implement and maintain

- Requires plant-wide buy-in to track non-production hours

- Doesn’t replace basic costing; it refines it

Formula:

Overhead per unit = Total Activity Cost ÷ Units impacted

e.g., $3,000 (QA & changeover) ÷ 10,000 units = $0.30 per unit overhead

Verdict:

Ideal for complex facilities with frequent changeovers, short runs, or multiple production lines.

4. Process Costing

What it is:

Process costing averages total costs over a large, continuous production batch. It’s used when products are indistinguishable and produced in bulk.

Use case:

A soybean oil refinery processes 100,000 liters of oil per week. Cost per liter is calculated by dividing the total weekly cost by the total liters produced.

Pros:

- Simple and efficient for bulk operations

- Fits continuous, homogeneous production models

- Easy to track average cost trends over time

Cons:

- Doesn’t work for differentiated SKUs or discrete units

- Hides variability in ingredient quality or process waste

- Poor fit for SKU-level decision-making or co-product tracking

Formula:

Unit Cost = Total Batch Cost ÷ Total Batch Quantity

e.g., $250,000 ÷ 100,000 liters = $2.50 per liter

Verdict:

Best for large-scale commodity processors. Not suited for operations with multiple SKUs or value-added differentiation.

5. Job Costing

What it is:

Job costing tracks all costs (materials, labor, overhead) tied to a specific batch, order, or job. It’s used when products are made to order or in small, unique batches.

Use case:

A craft chocolate company makes custom holiday gift boxes. Each job in a candy and confectionery business varies based on the type of candy, packaging, and client-specific requirements. Job costing tracks the profitability of each custom order.

Pros:

- Offers granular visibility into each job’s profitability

- Helps with quoting, pricing, and client-level margin tracking

- Ideal for small-batch, seasonal, or custom production

Cons:

- Requires detailed data entry per job or batch

- Becomes complex if jobs share overlapping production steps

- Harder to scale without a strong ERP or job-tracking system

Formula:

Unit Cost per Job = (Materials + Labor + Overhead for Job) ÷ Total Output Units

e.g., ($1,200 + $500 + $300) ÷ 500 units = $4.00 per unit

Verdict:

Perfect for specialty food makers, co-packers, or custom meal prep companies. Most effective when integrated with ERP to automate job tracking and reporting.

The Domino Effect of Poor Cost Visibility

In food manufacturing, not knowing the true cost of your products doesn’t just affect your accounting reports; it affects everything. From pricing and inventory to production decisions and profitability, one weak link in cost visibility can trigger a chain reaction of problems across your entire operation.

Poor cost accounting for food manufacturing directly impacts:

1. Pricing Products on Faulty Ground

Let’s say your costing model doesn’t capture yield loss from peanut butter sticking to mixing tanks. You’ll end up underestimating the costs of batch management and setting prices too low. Whether you’re producing ready-to-eat meals, snacks, or dairy-based items, inaccurate pricing from weak costing data leads to thin (or negative) margins, especially with fluctuating ingredient prices. This skews your gross margin by channel and makes high-volume SKUs appear more profitable than they are.

2. Inventory That Looks Full But Fails You

If you’re not factoring in shrinkage, spoilage, or variable batch sizes during production of perishable items like fresh juice or salad kits, your inventory valuation becomes unreliable. This results in stockouts of critical components, overproduction of low-demand items, and excessive storage costs, all while distorting inventory turnover rates and price per unit produced.

3. Misleading Margin Reports

Margins on a protein bar might look great until you realize your model didn’t allocate machine cleaning downtime, allergen changeover labor, or freight surcharges for temperature-controlled shipping. This is where cost accounting for food manufacturing makes a difference by assigning actual costs to each unit, batch, and SKU, not just averages. Without this clarity, your profit per production run can be wildly off base.

4. Bad Data, Worse Decisions

You may think you’re optimizing by shifting production to a co-packer or promoting a particular SKU, but if your costing data ignores packaging waste, seasonal labor premiums, or utility spikes during night shifts, your decisions are misinformed. These blind spots inflate performance metrics and lead to costly strategy misfires, primarily when cost-to-produce per SKU isn’t rooted in reality.

What Top Food Processors Do Differently

While many manufacturers continue to struggle with thin margins and unclear product profitability, top-performing processors have made cost visibility a daily operational discipline, not a finance department afterthought. They’ve redefined how cost accounting for food manufacturing works in real time, at the SKU level, and across departments.

Here’s what they do differently:

1. They Cost Every SKU—Individually and Accurately

Top processors don’t rely on broad averages or product category-level costing. They track inputs, labor, and overhead at the individual SKU level, factoring in recipe variations, batch sizes, packaging formats, and co-manufacturing runs. This granularity helps them identify which SKUs are truly profitable, which are draining resources, and which need reformulation or repricing.

2. They Use ERP Systems Built for Food Manufacturing

Generic ERP platforms often fall short when it comes to the real-time, ingredient-level costing that food processors require. Top manufacturers use food-specific ERP systems that integrate:

- Batch-level ingredient tracking with yield adjustments

- Labor and overhead allocations tied to work orders or production runs

- Real-time inventory valuation that accounts for spoilage, shrinkage, and rework

- Actual vs standard variance reporting so finance, ops, and planning are aligned

- Co-packing and private label costing with isolated BOMs and margin analysis

A food manufacturing ERP, such as the one offered by Folio3 FoodTech, provides manufacturers with visibility into the true cost-to-produce for each unit, including indirect costs like line changeovers, sanitation downtime, and packaging waste. This level of detail empowers faster and more confident decisions in pricing, food procurement management, and promotions.

3. They Monitor Yield and Waste in Real Time

Instead of treating yield loss and rework as unavoidable write-offs, top processors track these costs by line, shift, or even operator. They assign costs to overfills, damaged packaging, underweights, or sanitation losses, feeding that data back into their costing model. This gives a clearer view of where margins are really being lost and which lines or teams need process improvement.

4. They Model Ingredient and Supplier Changes Before Committing

Smart processors don’t guess what a new supplier or formulation will cost; they simulate it. With real-time BOMs and costing engines integrated into their ERP, they model alternative ingredients, packaging sizes, or shift patterns to understand the financial impact before making a decision. This minimizes surprises and enables them to scale successful pilots more quickly.

5. They Connect Costing with Planning, Sales, and Sourcing

Cost accounting for food manufacturing isn’t siloed; it drives decision-making across departments. Leading companies link costing to demand planning and sales strategy, ensuring that promotions don’t push low-margin items and procurement doesn’t chase “savings” that reduce yield. Everyone works off a single source of truth.

How to Fix Cost Accounting In Your Food Manufacturing Business With ERP

Fixing cost accounting for food manufacturing starts with eliminating blind spots between operations and finance. Here is how Food ERP helps businesses do better cost accounting:

- Automated Data Capture From Production Lines: ERP pulls data from shop floor systems (e.g., scales, PLCs, MES) to log actual ingredient usage, yields, and scrap, giving real-time input-output ratios.

- Batch-Level Costing and Traceability: Each production batch is tracked with its own BOM, actual materials consumed, labor hours, energy used, and output, allowing precise cost assignment to every SKU.

- Live Inventory Valuation: As inventory moves, whether it’s consumed, spoiled, or reworked, the ERP adjusts material and WIP values, reflecting fundamental cost changes across locations.

- Dynamic Overhead Allocation Rules: The system lets you define cost drivers (e.g., machine hours, labor time, batch complexity) to allocate shared costs more accurately across products and lines.

- Built-In Manufacturing Costing Methods: You can configure the ERP to apply Standard, Actual, or Activity-Based Costing per product line, customer contract, or plant, without external spreadsheets.

- Integrated Variance Reporting: The ERP flags deviations between planned and actual costs, by ingredient, batch, or production line, enabling finance teams to correct issues more quickly.

With these ERP capabilities, cost accounting for food manufacturing becomes a tightly integrated, accurate, and auditable process, providing you with true visibility into margins.

Conclusion

Getting cost accounting right in food manufacturing isn’t just about fixing reports; it’s about seeing your business clearly. When costing is inaccurate, pricing, margins, and inventory decisions are also affected. And in an industry where waste, yield loss, and fluctuating inputs are the norm, that’s a risk you can’t afford.

Modern ERP systems give food manufacturers the tools to build costing around how their operations actually work. From tracking real-time yield loss to allocating shared labor across SKUs, ERP helps you move from guesswork to clarity, so every decision is grounded in accurate, up-to-date cost data.

FAQs

What Is Cost Accounting In Food Manufacturing?

Cost accounting for food manufacturing involves tracking and analyzing all costs tied to production, ingredients, labor, and overhead to understand true product margins and make better financial decisions.

How Does Folio3’s Food ERP Help With Cost Accounting?

Folio3 FoodTech ERP automates cost tracking in real time, capturing yield loss, allocating shared costs, and supporting multiple manufacturing costing methods for accurate product-level costing and smarter pricing.

What Are The Best Manufacturing Costing Methods For Food Businesses?

The most effective manufacturing costing methods for food businesses include Actual Costing, Standard Costing, and Activity-Based Costing. Each of them offers different insights depending on operational complexity and product variability.

How Does Cost Accounting Improve Profitability?

Accurate cost accounting for food manufacturing reveals your true margins, highlights inefficiencies, and supports better pricing and inventory decisions, so food manufacturers can control costs, reduce waste, and improve overall profitability.